In the fintech industry, trust, reliability, and user experience matter more than almost anything else. Whether you’re running a payments platform, digital wallet, neobank, or lending product, customers expect things to work smoothly every time. Even small issues can quickly impact confidence and long-term retention.

But learning what users actually think and feel about your product is difficult. Product analytics can tell you what users do, but not how they feel about your features, pricing, or support.

This is where a structured feedback email flow becomes essential. A feedback email sequence helps you consistently collect insights, identify gaps, and improve the overall customer experience.

In this guide, we’ll walk through how to build a complete feedback email sequence for fintech from scratch.

Why should you use an email flow?

Email works exceptionally well for collecting feedback in fintech because it’s a trusted, direct channel customers already associate with important updates like transactions, security alerts, and account summaries. Unlike in-app prompts, emails don’t interrupt critical actions or workflows.

With email, you can:

Reach customers directly in a familiar and credible environment

Explain why their feedback matters and how it will be used

Personalize feedback requests based on usage, features, or lifecycle stage

Segment users to collect more relevant and actionable insights

Automate reminders and follow-ups without manual effort

But a single feedback email rarely delivers strong response rates. Some users miss the first email, others postpone responding, and some need a reminder or incentive. A short email sequence accounts for these behaviors and helps you consistently gather meaningful feedback without being intrusive.

What is a feedback email sequence?

A feedback email sequence is a series of automated emails sent to customers to collect, acknowledge, and act on their feedback over a defined period of time.

In fintech, this sequence usually includes:

- An initial feedback request

- A reminder or incentive to reduce friction

- A follow-up that acknowledges the user’s response

How to build a feedback email sequence

Building an email sequence can be easy if you’re following a well-defined set of steps. Here are the steps for you to follow:

Step 1: Plan your campaign

Before creating any emails, it’s important to clearly define what you want to achieve with your feedback sequence. A well-planned campaign ensures you ask the right questions and reach the right users at the right time.

For a fintech feedback email flow, your campaign plan should outline:

- Objective: Collect product and experience feedback to improve features, usability, and trust

- Audience: Active customers who have used key features in the last 3–6 months

- Messaging: Simple, reassuring, and focused on improvement

- Number of emails: 3 emails

- Timeline: 4 days

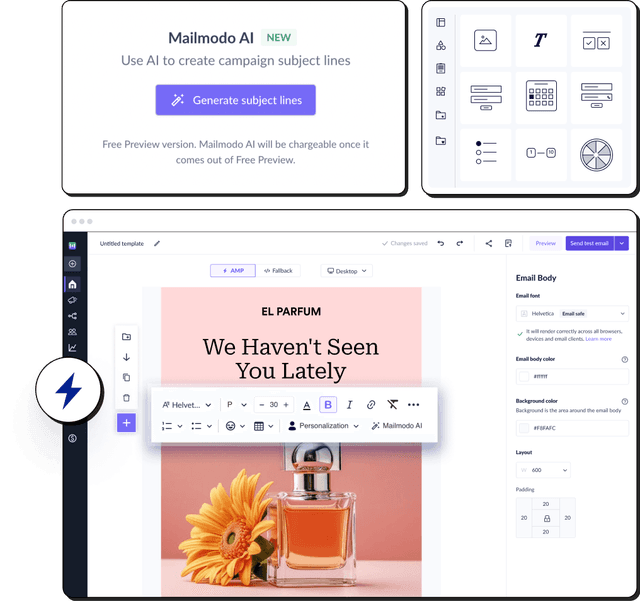

We asked Mailmodo AI to generate an entire campaign plan for a price drop email sequence and it delivered a detailed, actionable plan that we could review, customize, and turn into an automated workflow instantly. The output also outlined what emails to send, when to send them, and what each message should achieve.

Take a look at the prompt we used. Click on the arrow to see the output we received.

Create a customer feedback campaign plan for a fintech product. Include objectives, target audience, number of emails, timing between emails, and the main goal of each email in the sequence.

Step 2: Create audience segments

Not all fintech users should receive the same feedback request. Segmentation helps you collect more relevant insights and avoid bothering users who aren’t ready to respond. For a feedback email sequence, you can segment users based on:

- Account status (active vs inactive)

- Recent activity (payments made, transactions completed)

- Time since signup

- Feature usage (cards, loans, investments, payouts)

- Customer type (retail, SMB, enterprise)

We used Mailmodo AI to quickly create an audience segment for this email sequence. Once it was done, we got the option to review, make edits using the builder, or ask AI to carry out the changes we wanted. Once we confirmed, Mailmodo AI created the segment instantly and it was ready to use for a campaign.

Take a look at the prompt we used, along with the output we got.

Create a dynamic segment of fintech users who are active, completed at least one transaction in the last 90 days, and have not submitted any feedback in the last 3 months.

Step 3: Create the email templates

Once your audience is ready, the next step is to design the emails that will make up your feedback sequence. Here’s a sample list of emails that you should be creating for your price drop email sequence. We’ve also included sample prompts that you can use in Mailmodo AI to generate these email templates in minutes instead of having to spend hours creating them.

Email #1: Feedback email

When to send: Day 0

Purpose: Collect feedback about the product and overall experience

What to include:

A short explanation of why feedback matters

Simple questions about product experience

Options to share feature suggestions or issues

A reassurance about data privacy and usage

Here’s a sample prompt to generate this kind of email, along with the output it will produce.

Generate a fintech feedback email asking users about their product experience, feature satisfaction, and suggestions for improvement. Keep the tone friendly, trustworthy, and concise.

Email #2: Incentivize

When to send: Day 2 (if no response)

Purpose: Reduce friction and motivate users to share feedback

What to include:

- A reminder about the feedback request

- A small incentive (voucher, cashback, feature access)

- Emphasis on how little time it takes

- A clear call to action

Here’s a sample prompt to generate this kind of email, along with the output it will produce.

Generate a follow-up feedback email for a fintech product that offers an incentive such as cashback or a voucher to encourage responses.

Email #3: Acknowledgement

When to send: Day 4

Purpose: Close the loop and build trust

What to include:

- A thank-you message for sharing feedback

- Acknowledgement of positive or negative input

- A brief note on how feedback will be used

- Reassurance that the team is listening

Here’s a sample prompt to generate this kind of email, along with the output it will produce.

Generate a feedback acknowledgement email for a fintech product. Thank users for their input and explain how the feedback will be used to improve the product and experience.

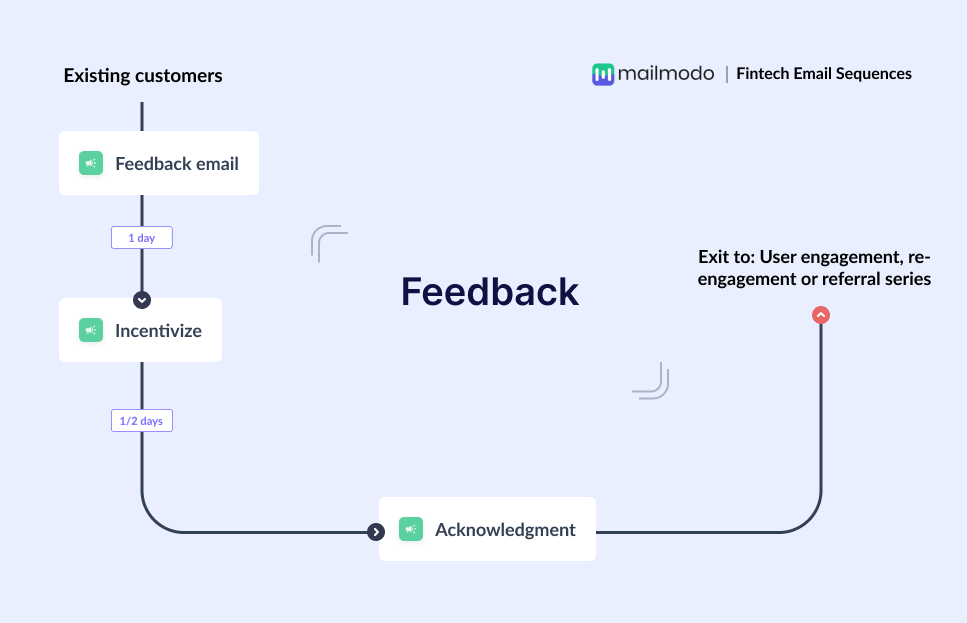

Step 4: Build the automated workflow

After creating the emails, the next step is to connect them into an automated workflow so the sequence runs smoothly without manual effort. For this feedback email sequence, the workflow looks like this:

- Trigger: User enters the feedback-eligible segment

- Delays: 0 days → 2 days → 2 days

- Branching logic: If feedback submitted → skip incentive email; If feedback not submitted → send incentive email

- Exit criteria: Feedback submitted or sequence completed

We used Mailmodo AI to generate the full workflow logic, including triggers, delays, and conditions. Once the output was ready, we just had to review the overall journey following a setup checklist and ask the AI to make the tweaks we wanted in the workflow.

Take a look at the prompt that we used and the output we received.

Generate a complete automated workflow for a fintech feedback email sequence. Include triggers, delays, conditional logic based on feedback submission, and exit criteria.

Step 5: Analyze and improve

Monitoring performance helps you understand what went well with your feedback campaign and what didn’t. This helps you improve future feedback campaigns. For a fintech feedback sequence, track metrics such as:

- Open rate

- Response rate

- Completion rate

- Positive vs negative feedback ratio

- Common themes or feature requests

You can also ask Mailmodo AI to analyze the performance of your email sequence and suggest optimizations based on engagement and conversion data. Here’s a sample prompt that you can use for this:

Analyze my fintech feedback email sequence and suggest improvements to increase response rates and quality of feedback.

Conclusion

A well-designed feedback email sequence ensures you consistently hear from your users without overwhelming them. You can collect better insights, respond thoughtfully, and show customers that their opinions truly matter.

When paired with automation and AI, planning, creating, and optimizing these sequences becomes far more efficient. With tools like Mailmodo, fintech teams can simplify the entire process and focus on what really matters, turning feedback into meaningful product improvements.