In the fintech industry, getting users to sign up is only half the job. Whether you offer investments, loans, crypto, or cashback features, the real challenge is helping users understand the product and actually use it with confidence.

Many fintech users feel overwhelmed by choices, unsure about risks, or hesitant to take the first step. If they don’t see value quickly, they disengage. That’s where a user engagement or product adoption email sequence becomes essential.

A structured email flow helps educate users, nudge them toward action, and build trust over time. In this guide, we’ll walk through how to build a complete product adoption email sequence for fintech.

Why should you use an email flow?

Email works especially well for product adoption in fintech because it combines trust, timing, and personalization.

Unlike push notifications or in-app messages, email gives you space to explain complex concepts like returns, risks, eligibility, or benefits. You can tailor messages based on user behavior, such as browsing a loan product or checking investment options, and send the right message at the right time.

But most fintech decisions aren’t instant. Users need multiple touchpoints to:

- Understand the product

- See how it fits their needs

- Feel confident enough to act

That’s why one email isn’t enough. A sequence allows you to educate first, nudge next, and then support the decision with proof and resources. This naturally leads us to defining what a product adoption email sequence really is.

What is a product adoption email sequence?

A product adoption email sequence is a series of automated emails sent to users to help them understand, try, and adopt a product or feature into their daily lives.

It usually includes product introductions, gentle reminders, benefit-driven nudges, and helpful resources that remove doubts. These emails work together to guide users from awareness to action, setting the stage for long-term engagement.

How to build a product adoption email sequence

Building an email sequence can be easy if you’re following a well-defined set of steps. Here are the steps for you to follow:

Step 1: Plan your campaign

Planning sets the foundation for the entire sequence. In fintech, this step is critical because you’re dealing with money, trust, and regulated products.

Start by clearly outlining:

- Objective: Increase usage of a specific product or feature

- Target audience: New users, existing inactive users, or feature explorers

- Core message: Why this product matters to them

- Number of emails: Typically 3

- Timeline: 2–4 days to keep momentum without overwhelming users

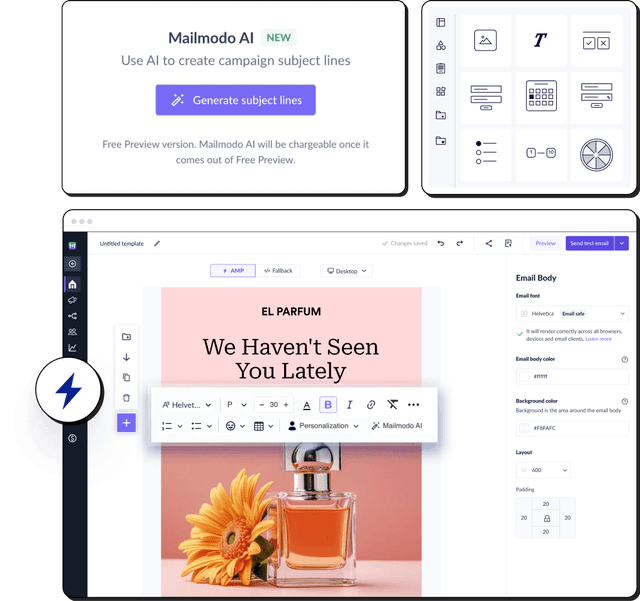

We asked Mailmodo AI to generate an entire campaign plan for a product adoption email sequence and it delivered a detailed, actionable plan that we could review, customize, and turn into an automated workflow instantly. The output also outlined what emails to send, when to send them, and what each message should achieve.

Take a look at the prompt we used. Click on the arrow to see the output we received.

Create a product adoption email campaign plan for a fintech app. Include objectives, number of emails, the theme of each email, ideal timing, and the main CTA for each email.

Step 2: Create audience segments

Segmentation ensures your emails feel relevant and personal, not generic. This makes your emails more effective and results in wider adoption of your product. In fintech, segmentation often depends on behavior and user intent. You can segment users based on:

- Products viewed (investments, loans, crypto)

- Feature usage (cashback enabled, KYC completed)

- Lifecycle stage (new user, inactive user)

- Risk profile or preferences

We used Mailmodo AI to quickly create an audience segment for this email sequence. Once it was done, we got the option to review, make edits using the builder, or ask AI to carry out the changes we wanted. Once we confirmed, Mailmodo AI created the segment instantly and it was ready to use for a campaign.

Take a look at the prompt we used, along with the output we got.

Create a dynamic segment of fintech users who signed up in the last 14 days, viewed at least one product, but haven’t completed a transaction.

Step 3: Create the email templates

Now it’s time to design the actual emails that users will receive. Here’s a sample list of emails that you should be creating for your price drop email sequence. We’ve also included sample prompts that you can use in Mailmodo AI to generate these email templates in minutes instead of having to spend hours creating them.

Email #1: Offering email

When to send: Immediately after the launch

Purpose: Introduce relevant products or features

What to include:

- Brief product overview

- Key benefits and standout features

- Personalization based on user interest

- Clear next step (explore or try)

Here’s a sample prompt to generate this kind of email, along with the output it will produce.

Generate an offering email for a fintech app introducing investment and cashback features. Include benefits, simple explanations, and a CTA to explore the product.

Email #2: Nudge

When to send: 1 day after Email #1

Purpose: Encourage users to take action

What to include:

- Reminder of the product value

- Light urgency or motivation

- Address common hesitation

- Strong but friendly CTA

Here’s a sample prompt to generate this kind of email, along with the output it will produce.

Create a nudge email encouraging users to try a fintech product they recently explored. Focus on motivation and ease of getting started.

Email #3: Helpful resources

When to send: 1–2 days after Email #2

Purpose: Build trust and reduce risk perception

What to include:

- Educational content or guides

- FAQs or common concerns

- Articles or documents backing claims

- Reassurance around safety and benefits

Here’s a sample prompt to generate this kind of email, along with the output it will produce.

Generate a fintech email sharing helpful resources that explain product benefits, address risk concerns, and build user confidence.

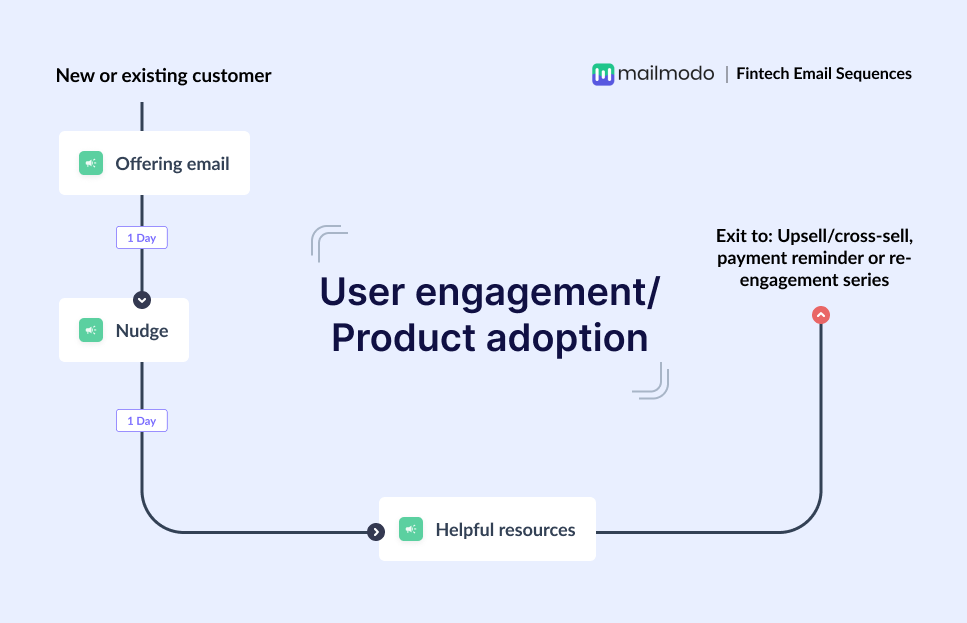

Step 4: Build the automated workflow

Once your emails are ready, the next step is to automate them so every new user receives them at the right moment. Your product adoption email sequence should include:

- Trigger: User enters product adoption segment

- Delays: 0 days → 1 day → 1–2 days

- Branching logic: If user takes action → exit sequence; If inactive → continue sequence

- Exit criteria: User completes a transaction or activates the feature

We used Mailmodo AI to generate the full automated workflow from scratch. It mapped triggers, delays, conditions, and exits. Once the output was ready, we just had to review the overall journey following a setup checklist and ask the AI to make the tweaks we wanted in the workflow.

Take a look at the prompt that we used and the output we received.

Generate a complete automated workflow for a fintech product adoption email sequence. Include triggers, delays, branching logic, and exit criteria.

Step 5: Analyze and improve

Once the sequence is live, you can track the performance of your sequence to improve future campaigns. Key metrics to track include:

- Open rate

- Click-through rate

- Product usage or activation rate

- Drop-off points in the sequence

You can also ask Mailmodo AI to analyze the performance of your email sequence and suggest optimizations based on engagement and conversion data. Here’s a sample prompt that you can use for this:

Analyze my fintech product adoption email sequence and suggest improvements to increase engagement and product usage.

Conclusion

Email sequencing turns product discovery into a guided journey rather than a one-time message. With tools like Mailmodo, planning, creating, automating, and optimizing these sequences becomes far simpler and more consistent.

Once set up, this flow keeps working in the background, helping users get value from your product while strengthening long-term engagement.