In the fintech industry, acquiring a new customer often involves high trust barriers, long decision cycles, and significant marketing spend. That’s why growth doesn’t come only from new sign-ups, but from deepening relationships with existing users.

Customers who already use one financial product, such as a savings account, loan, or investment plan, are far more likely to adopt additional or higher-value products when they clearly see that they’re benefiting from the former one. However, pitching everything at once or relying on one-off messages doesn’t work so well.

An upsell/cross-sell email sequence helps fintech companies introduce relevant products gradually, educate users, and nudge them toward smarter financial decisions. In this guide, we’ll walk you through how to build a complete upsell/cross-sell email sequence tailored specifically for you.

Why should you use an email flow?

Email works especially well for upsell and cross-sell in fintech because it’s a trusted, permission-based channel. Users expect important financial updates, product information, and recommendations in their inbox, making email a natural fit.

With email, fintech brands can personalize messages based on account type, transaction behavior, risk profile, or lifecycle stage. This makes it easier to recommend relevant upgrades like premium plans, higher credit limits, add-on services, or complementary products such as investments or insurance.

But financial decisions rarely happen instantly. Customers often need education, reassurance, and time to compare options. A single email can’t do all of that. An email flow allows you to introduce the offer, explain the value, and follow up thoughtfully without overwhelming the user.

What is an upsell/cross-sell email sequence?

An upsell/cross-sell email sequence is a series of automated emails sent to existing users to encourage them to upgrade their current financial product or adopt additional related products.

In fintech, these emails often include product recommendations, benefit explanations, comparisons, reminders, and support options. Together, they guide users from awareness to understanding and finally to action. Let’s look at how to build this sequence step by step.

How to build an upsell/cross-sell email sequence

Building an email sequence can be easy if you’re following a well-defined set of steps. Here are the steps for you to follow:

Step 1: Plan your campaign

Campaign planning is critical in fintech because messaging must be clear, compliant, and customer-centric. A strong plan ensures your emails educate first and sell second. Start by aligning the upsell or cross-sell with a genuine user need, such as better returns, convenience, or financial security.

Your campaign plan should define:

- Objective: Upgrade to a premium plan or cross-sell a related financial product

- Target audience: Existing users based on product usage or financial behavior

- Core message: How the new product improves their financial outcome

- Number of emails: 3 emails

- Timeline: 4 days

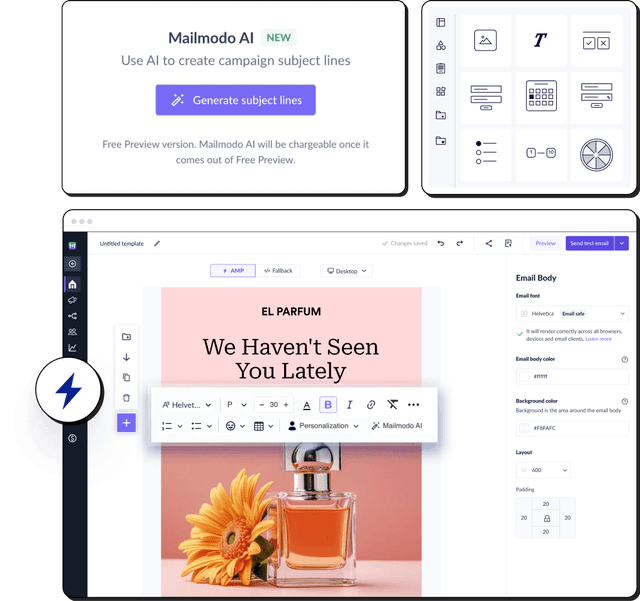

We used Mailmodo AI to generate a structured campaign plan for a fintech upsell/cross-sell sequence and it delivered a detailed, actionable plan that we could review, customize, and turn into an automated workflow instantly. The output also outlined what emails to send, when to send them, and what each message should achieve.

Take a look at the prompt we used. Click on the arrow to see the output we received.

Create an upsell/cross-sell email campaign plan for a fintech company. Include objectives, number of emails, goals of each email, and ideal timing.

Step 2: Create audience segments

Segmentation is especially important in fintech, where relevance and trust go hand in hand. Users are more likely to convert when recommendations align with their financial behavior. You can segment users based on:

- Product currently used (loan, savings, card, investment)

- Account balance or usage level

- Transaction or repayment behavior

- Risk or investment profile

- Time since account activation

We used Mailmodo AI to quickly create an audience segment for this email sequence. Once it was done, we got the option to review, make edits using the builder, or ask AI to carry out the changes we wanted. Once we confirmed, Mailmodo AI created the segment instantly and it was ready to use for a campaign.

Take a look at the prompt we used, along with the output we got.

Create a dynamic segment of fintech users who are on a basic plan and have been active in the last 30 days but haven’t upgraded or added new products.

Step 3: Create the email templates

Once the audience is defined, the next step is creating the actual emails to be sent. Here’s a sample list of emails that you should be creating for your upsell/cross-sell email flow. We’ve also included sample prompts that you can use in Mailmodo AI to generate these email templates in minutes instead of having to spend hours creating them.

Email #1: Offering email

When to send: Day 0–1 after trigger

Purpose: Introduce the upgrade or additional product

What to include:

- Clear overview of the product or plan

- Why it’s relevant to their current usage

- One focused CTA

Here’s a sample prompt to generate this kind of email, along with the output it will produce.

Generate an upsell email for a fintech product. Introduce a relevant upgrade based on a user’s current plan and usage.

Email #2: Benefits email

When to send: 2 days after Email #1

Purpose: Educate and build confidence

What to include:

- Key benefits and outcomes

- Feature comparisons with the current product

- Real-life financial use cases

Here’s a sample prompt to generate this kind of email, along with the output it will produce.

Generate an email explaining the benefits of a fintech product upgrade. Include feature comparisons and customer-focused outcomes.

Email #3: Nudge email

When to send: 4 days after the first email

Purpose: Encourage final action

What to include:

- Friendly reminder

- Optional urgency or incentive

- Access to support or educational resources

Here’s a sample prompt to generate this kind of email, along with the output it will produce.

Generate a final reminder email for a fintech upsell/cross-sell sequence. Include a soft nudge and support options.

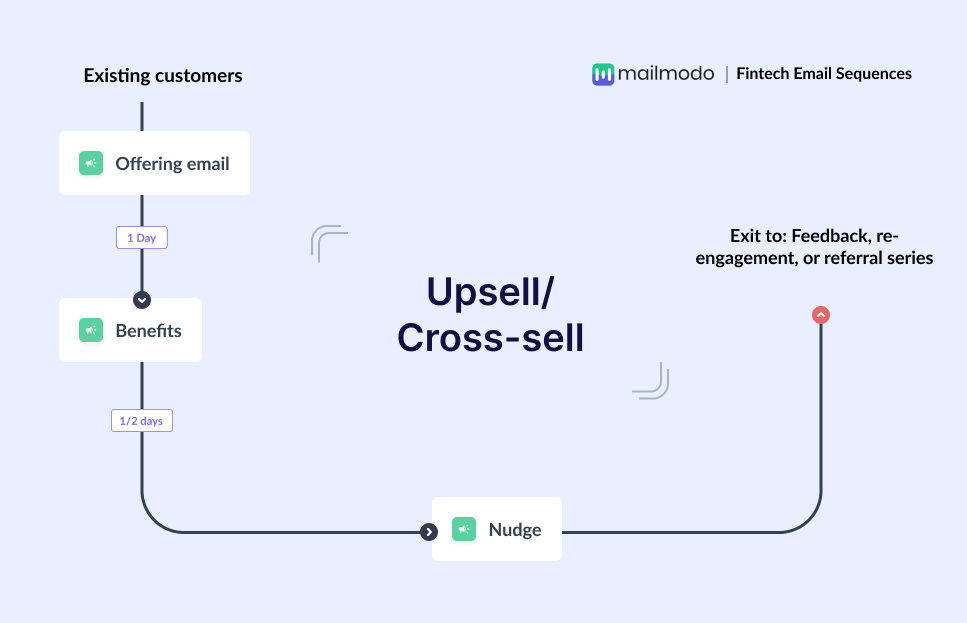

Step 4: Build the automated workflow

Once your emails are ready, the next step is to automate them so every new user receives them at the right moment. Your price drop email sequence should include:

- Trigger: User completes a transaction or activates an account

- Delays: 0 days → 2 days → 2 days

- Branching logic: If user upgrades or buys → exit sequence; If not → continue to next email

- Exit criteria: Product upgrade or sequence completion

We used Mailmodo AI to generate the full automated workflow from scratch. It mapped triggers, delays, conditions, and exits. Once the output was ready, we just had to review the overall journey following a setup checklist and ask the AI to make the tweaks we wanted in the workflow.

Take a look at the prompt that we used and the output we received.

Generate a complete automated workflow for a fintech upsell/cross-sell email sequence. Include triggers, delays, branching logic, and exit criteria.

Step 5: Analyze and improve

Once the sequence is live, you can track the performance of your sequence to improve future campaigns. Key metrics to track include: Important metrics to track include:

- Open rate

- Click-through rate

- Conversion or upgrade rate

- Revenue per user

- Drop-off between emails

You can also ask Mailmodo AI to analyze the performance of your email sequence and suggest optimizations based on engagement and conversion data. Here’s a sample prompt that you can use for this:

Analyze my fintech upsell/cross-sell email sequence and suggest improvements to increase engagement and conversions.

Conclusion

Upsell and cross-sell strategies are essential for sustainable growth in fintech. By helping users discover better plans or complementary financial products, you increase lifetime value while delivering real customer value.

Email sequencing makes this process structured and user-friendly by spreading education and nudges across multiple touchpoints. With the right segmentation, messaging, and automation, these sequences can drive consistent revenue growth.

Mailmodo simplifies the process of planning, creating, automating, and optimizing upsell/cross-sell email sequences for fintech teams. With AI support, you can move faster while staying focused on clarity and trust.